When the Phillips don’t meet the requirements, Blackmon penned — that have apologies in order to folksinger Arlo Guthrie — why did not the financial institution say so with “mathematic equations, pie charts, and club graphs, the with the 8 by ten glossy pictures report, which have sectors and you will arrows and you may sentences on the rear detailing for every single profitable number”?

“Either, precisely the courts out-of legislation stand to protect the fresh taxpayer. Someplace, individuals has to stand up,” Blackmon wrote in a beneficial five-page The fall of. dos buy into the Carroll State Advanced Legal. “Better, sometimes is becoming, therefore the lay ‘s the High Condition regarding Georgia. The brand new defendant’s activity to discount are hereby refuted.”

Blackmon’s acquisition attempt down U.S. Bank’s consult to help you get rid of an issue off Georgia citizen Otis Wayne Phillips, that has tried to score home financing modification on financial. Phillips couldn’t be achieved because of it tale.

The transaction lies the fact out in this way: Phillips is within likelihood of foreclosures. You.S. Lender is among the “poorly work with organizations” you to recently obtained huge bailouts in the national and you may agreed to participate in the brand new Obama administration’s Domestic Sensible Amendment System. “

HAMP assistance want banking companies to adopt home owners to own variations once they is located at risk of shedding behind to their money because of a pecuniary hardship assuming the monthly mortgage expenses take up over 31 % of the income.

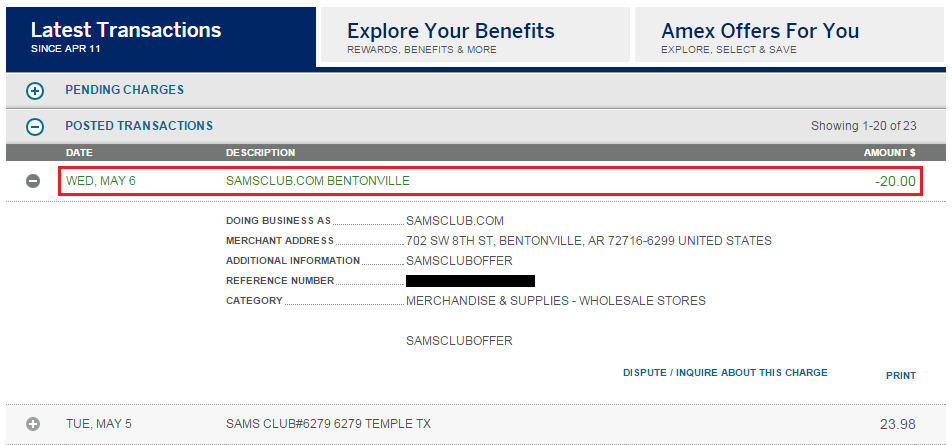

“Which courtroom usually do not envision as to why U.S. Lender cannot make known to Mr. Phillips, an excellent taxpayer, how their wide variety place your outside of the federal guidance to receive financing amendment,” Blackmon went on. “Delivering $20 mil away from taxpayer money was nothing wrong for You.S. Financial. A pessimistic courtroom you are going to accept that which whole actions so you’re able to disregard is actually a hopeless you will need to end an advancement months, where You.S. Bank would have to tell Mr. Phillips how their financial predicament failed to meet the requirements your getting good amendment.”

“Possibly You.S. Financial not have some of the $20 billion leftover, and so its shortage of composed reason could well be attributed to some type of ink avoidance system to save cash,” Blackmon went on. “Certainly, You.S. Bank don’t take the money, price with the authorities to incorporate a service into the taxpayer, violate one contract, following state nobody in the world is sue all of them getting it. That’s not regulations in the Georgia.”

“It just shows new anger of your process of law to the objections getting cutting-edge from the financial servicers continuously as well as over once more,” North carolina attorney Max Gardner told HuffPost. “I think you could discover the fresh outrage into the all corners of that buy.”

As their discharge in 2009, your house Reasonable Amendment program has been plagued by issues from forgotten data files and you can miscommunication out of banks’ mortgage servicing divisions. Fewer people have received long lasting modifications than have been booted off the program. Banks may use an enthusiastic opaque “Internet Establish Really worth” decide to try so you’re loans in Kim able to refuse a citizen in the event the an amendment was shorter profitable than simply a foreclosures.

Homeowners keeps produced a wave regarding still-constant lawsuits up against banks for financial maintenance abuses, and you can an excellent coalition off condition lawyer general happens to be settling having the most significant banks having money who change the mortgage repair world and provide specific relief in order to homeowners. One to settlement, whether it actually goes, would not preclude consumers out of filing their particular says, in the event Gardner ideal financial institutions would use it influence during the legal.

Blackmon’s buy says Georgia law lets states for violation regarding a good obligation of great trust and you will fair coping, and that there are 2 deals at issue: the new bank’s contract to sign up HAMP and its particular mortgage which have Phillips. The way it is is coming so you’re able to good jury demo. “While you are hard to explain, jurors see good-faith and you will fair dealing after they notice it, and you can jurors can also be spot the absence of exact same.”

When Phillips applied for a modification, the lending company refused their request “in the place of quantity, numbers, or reason, cause, review so you can direction, or something

“New court’s acquisition include many informative and you may legal problems,” Joyce told you. “With the broader point, foreclosure is almost always the final resort having borrowers plus the lender. That is why we now have caused tens of thousands of consumers nationwide toward altering its mortgage loans to enable them to do the costs and you will stay static in their homes.”