If you are to the family seem, you’ll you need a mortgage to go right along with it. While you might be tempted to see a lender otherwise mortgage-particular bank, a card commitment tends to be the best option. Here are half a dozen reason opting for a cards relationship for the mortgage is a victory for your house goals.

step 1. Better Support service

Borrowing from the bank unions has actually professionals, perhaps not consumers. Very borrowing from the bank unions live and breathe customer service, and find from their members just how much it take pleasure in the info and you may friendliness of teams.

Within a card union, possible work with anybody such as for example Home loan Maker, Beth Meyer. Beth has been part of FFCCU for over 25 years, involved in some section for the borrowing connection. Their unique knowledge and experience make their own a pro in the matching the fresh best economic equipment along with your individual need. And since a mortgage is actually private, you should modify it towards lifetime and you may financial wants.

2. Not-For-Finances Model Advantages Your as the an associate

Credit unions are not-for-money loans Louisville AL organizations, and therefore it reinvest each of their income back to the firm. Regarding a credit relationship, most of the investment goes back on the members regarding form of dividends. There are not any solid suit investors generating vast amounts to your the penny many it is back to you or any other players.

3. Far more Savings and you may Less Challenge

You might have heard one some loan providers will sell off the home loan the moment it’s signed. not, that is not apt to be the scenario that have a credit relationship. Credit unions usually choose keep and you will provider the home loan, when they in a position. What does which means that to you? Your likely already know the individuals which keep the loan, and they are easy to get in touch with when you yourself have issues.

Likewise, by keeping your loan within their profile, you are less inclined to sense escrow challenge or fee troubles that cause late fees. And also in the event that these issues manage occur, they are generally more straightforward to resolve.

Given that financial institutions is getting-earnings, they often times need to make economic behavior considering their shareholders. Simultaneously, since they are member-possessed, a card union’s main priority try providing its participants.

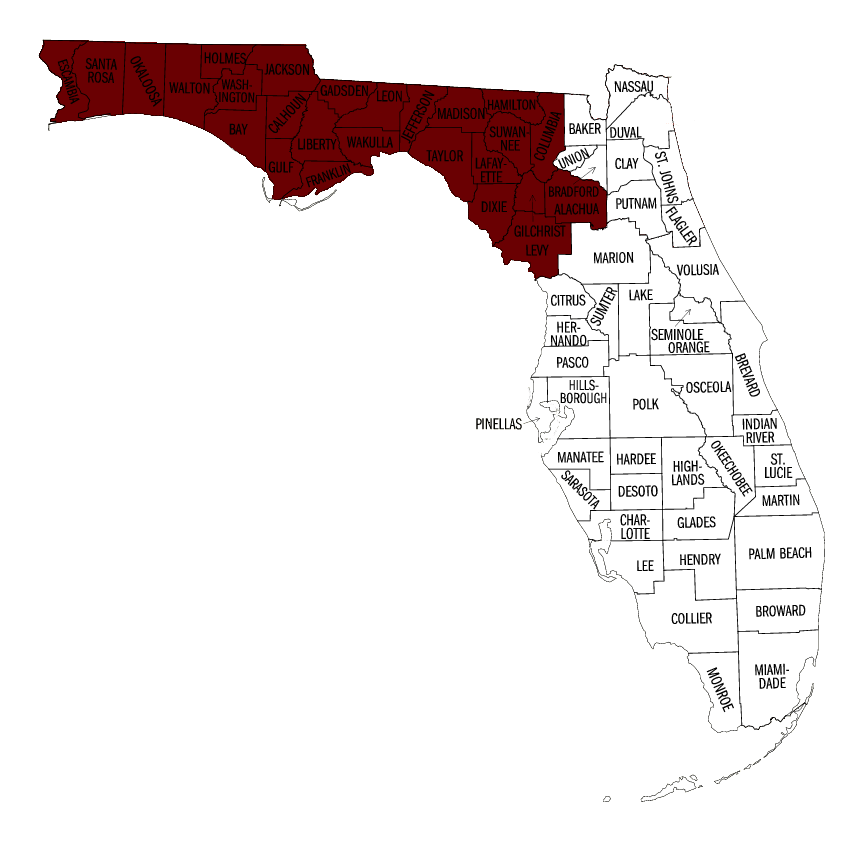

4. He’s got a heart circulation into Local Housing market

A residential district borrowing relationship, for example FFCCU, is actually a local providers. Since they are based where you live, they often times top learn local houses accessibility and restrictions. Seated having home financing maker of a credit relationship is frequently a very personal experience. Rather than just control a loan, they could make it easier to know for which you could possibly get face pressures when you look at the neighborhood markets and have your prepared for the process.

5. An effective Lifelong Connection

A love that have a cards union cannot prevent having delivering a mortgage. In reality, you member at your regional borrowing from the bank connection! Because borrowing unions try concerned about strengthening a monetary friendship having their players, they will strive to address any additional issues you have got.

While doing so, in the place of mortgage-just lenders, borrowing from the bank unions render many other products and services. You could potentially unlock savings account, auto loans, examining profile, and so much more, it is therefore your own that-end store for which you keeps private connectivity.

Analyze Your options

Remember, the team at the borrowing connection possess the back! They can give information what financial products are ideal for you. It could be not the right time and energy to refinance their home loan, however, a property guarantee financing or line of credit can make so much more feel. There are numerous household credit selection, therefore it is crucial that you know what is best for your circumstances.

Think about your most recent situation and FFCCU for the home loan otherwise re-finance partner. We are going to show you the financing connection variation. Prepared to get started? Fill in our home loan form to begin today.