A nearby Direction Agency regarding America (NACA) are an effective nonprofit providers aimed at and make homeownership sensible so you’re able to underserved borrowers in down-earnings groups. Their software give higher advantages eg no down repayments, settlement costs, individual financial insurance coverage (PMI), no credit score check-around the best brew for home hackers every-where.

- To house cheat no deposit, playing with good NACA home loan.

- NACA’s Household Pick System (also referred to as the Finest in America Financial System) was financing program built to assist low- so you can moderate-income anyone and you may household purchase a home.

- The NACA Family Get Program has numerous gurus, eg zero down repayments, no closing costs, without PMI.

- Even after their built-in masters, NACA funds have traditionally techniques times, limiting official certification, and you may home ownership restrictions.

What exactly is NACA?

Official of the Agencies of Casing and you may Metropolitan Invention (HUD), NACA’s objective would be to make dream of homeownership a real possibility for operating Us americans by guidance and you can enabling also people with poor borrowing from the bank to find a property otherwise tailor good predatory loan that have best terms and conditions.

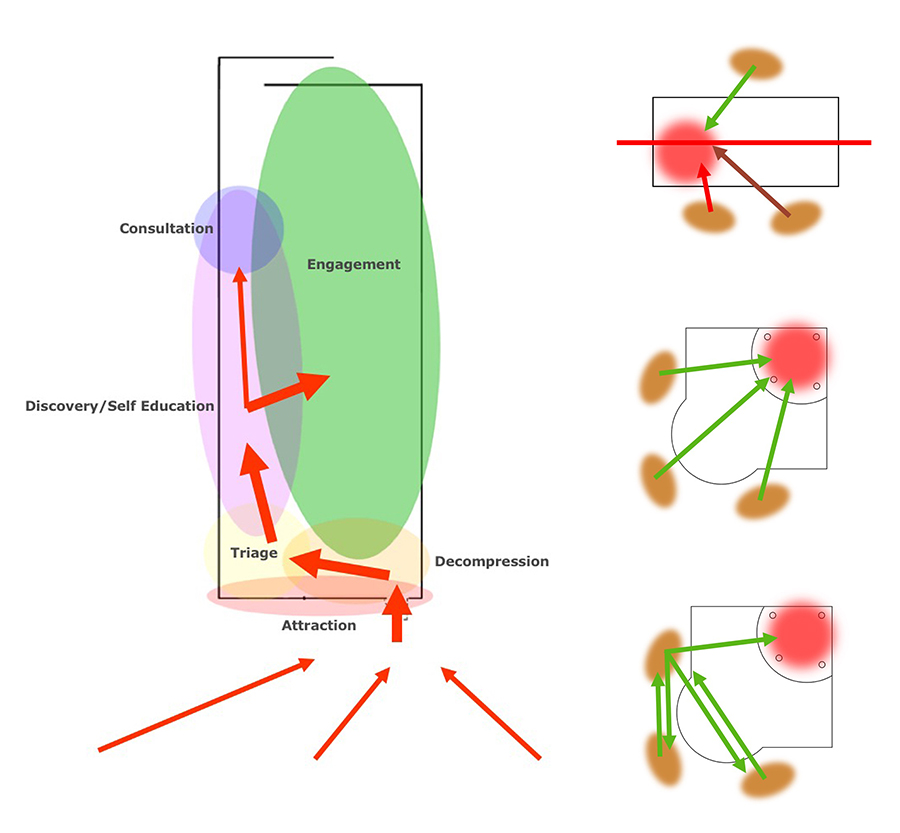

Professionals regarding NACA program run casing advisors and you can actual estate agents to guide all of them from the financial app process and you will promote all of them attempts such as the NACA Household Buy Program and something-Dollars Homeownership .

Certified players after that rating combined with spouse finance companies, together with Bank from America, that gives brand new loans. Borrowers who meet the requirements due to the fact members of the fresh NACA team must take care of membership requirements, including $twenty five annual dues and involvement in the NACA occurrences and products.

NACA’s Finest in The usa Financial Program

NACA’s Finest in The usa Financial System will bring sensible homeloan payment selection and you can lets borrowers to obtain one to mortgage that have possibly a fifteen- or 30-seasons term. NACA mortgages require no advance payment , zero settlement costs or fees, with no PMI. NACA will not look at the credit rating, but it does check your fee records.

Simultaneously, NACA’s Subscription Guidance Program (MAP) aids its home mortgage and you can loan software. From Map, participants can get in contact with NACA advisors getting advice about dealing with their financial situation in order to score homeloan payment recommendations.

Choices to Reduce your Rates

Adding step 1.5% of the financial total the newest advance payment decreases your own focus rate by the 0.25% to own 29 and you will 20-year funds. Having 15-12 months loans, 1% decreases the interest rate because of the 0.25%. That is tough to defeat.

Household Hacking & Spending which have a beneficial NACA Loan

You need to use a good NACA financial when selecting a house so you can home deceive. There are many ways to house deceive, regarding to order a California loans good multifamily possessions (desired by the NACA system) so you’re able to renting to help you housemates to buying a house with an accessory house product and.

If you purchase an excellent fourplex having good NACA financing, you can not only rating totally free property, nevertheless start up your real estate investment profile with many different doors in the a low interest.

NACA Financial Conditions

Though there’s no down payment requirement for a beneficial NACA home loan, the program requires you to definitely have bucks found in offers. This type of Minimal Requisite Funds become serious money came back from the closure, prepayment for assets taxation and you will insurance rates, or more so you can half a year off reserves for electric deposits and you will other expenses, with respect to the possessions as well as your financial situation.

NACA also demands that buy a house review and you may might need one to kepted more bucks to cover repairing people fitness, security, password, or architectural items known.

In the end, you should take care of a beneficial NACA membership during the a good status, which need a moderate $twenty five annual percentage and you will mandatory contribution for the at the very least four NACA events otherwise items every year, together with one ahead of certification and something in advance of closing. These types of events include advocacy tricks and you may volunteering items one to service NACA’s mission.