Home assessment

Nearly all conditional funds feature a provision into achievement regarding an expert family appraisal, which makes yes the actual value of your house aligns with the level of your property financial. You can even struggle to secure latest financing approval if the financial count exceeds the worth of the property youre buying.

Of several lenders also require the completion away from a home assessment previous so you’re able to closing. This step means that there are not any noticeable problems with the newest assets that will end in a significant monetaray hardship towards the borrower.

Present emails

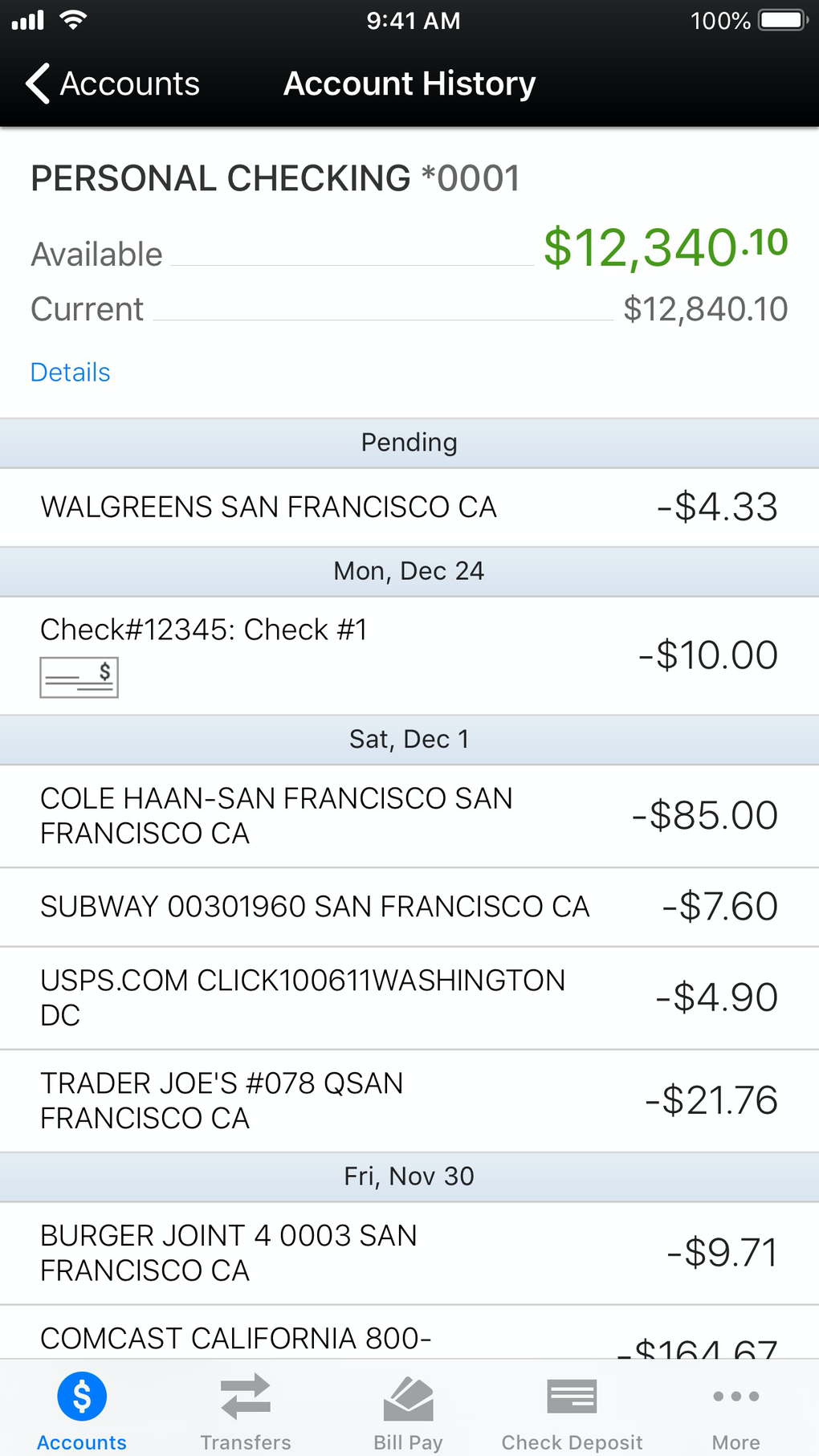

Sometimes, possible homeowners discovered economic merchandise from friends and family people so you can safeguards the cost of a downpayment. Although this shall be a great option for securing dollars to possess a down-payment, an unusual lump put to your checking account can lead to particular loan providers to help you question if it money is a loan otherwise good provide.

To help you calm such inquiries, their lender might need one to receive a present page away from anyone getting quite a bit of money with the their deposit. That it page just claims that money offered was something special and never that loan.

Home insurance publicity

www.paydayloanalabama.com/cardiff

A separate popular reputation of several lenders affix to a good conditional loan was the requirement into homebuyer to shop for homeowners insurance. Of many lenders perform an enthusiastic escrow membership that lets an excellent homebuyer make monthly payments into the their yearly home insurance superior. So it escrow amount will get part of your monthly mortgage repayments, and your homeowners insurance advanced try immediately given out out of this membership.

Alternatively, you could spend such advanced your self and you may ount. In either case, it’s likely that their bank will require you to definitely confirm you to definitely you have sufficient homeowners insurance visibility just before closure in your mortgage.

Good faith currency

Specific lenders otherwise providers might require that make a good trust energy by the placing a particular part of the loan worthy of towards an enthusiastic escrow membership. That it deposit, called good faith money, facilitate bolster the client’s status by allowing the lender otherwise provider discover they are serious about putting some buy.

During the closing, this good-faith money can go on the the new deposit for the house. However, for people who right back out of the sales, you risk dropping your bank account that deposit was non-refundable occasionally. When your financial means a good faith currency put, its important to have the specifics of this arrangement in writing. Be sure to check out the conditions and terms which means you fully understand the personal debt below this type of contract.

Oftentimes, you might secure preapproval having a home loan within just a great matter of days. On top of that, conditional mortgage approval usually takes up to 14 days otherwise extended to accomplish. Once you come across a home we would like to buy, you could potentially progress having protecting last mortgage acceptance.

Enough time it requires to acquire so it last recognition depends on just how long it requires one fulfill the specifications from brand new conditional financing. In order to automate this course of action, bear in mind the brand new actions you will want to done to invest in a home, instance a home evaluation and assets assessment. Stay static in close connection with your loan officer and try to provide any records and you will documents as fast as possible.

All of our simply take

While many realtors simply need you to get preapproval having a beneficial financial, taking the extra action in order to safe a great conditional loan also provide leverage when discussing toward seller. A beneficial conditional mortgage acceptance may leave you assurance knowing that the financial institution is likely to give final acceptance and you will lets you know right from the start just what individuals criteria your might have to satisfy prior to closing.

When applying for a home mortgage, it is very important gather this informative article to each other. Basic, this action means you happen to be offering the bank with precise advice possible. Next, such documents will be available in case the financial needs all of them.